Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP, provides a weekly update.

Investment markets and key developments

Global share markets fell again over the last week taking most markets below their mid-March lows in response to Trump’s higher than expected tariffs which in turn have led to increased fears of recession and a hit to profits. The falls in global shares and worries about the threat to the Australian economy saw the Australian share market fall around another 3.5%, with the falls led by resources, IT, utilities and retail shares. Bond yields fell reflecting safe haven demand swamping concerns about the tariffs adding to US inflation and as expectations for central bank rate cuts increased on the back of growth fears. Growth worries also weighed on metal, iron ore and oil prices with the latter also being hit by a surprisingly stronger increase in OPEC oil supply plans. Gold also rose on the back of safe haven demand, but the $US didn’t which saw the $A surprisingly rise over the last week. And Bitcoin fell with share markets.

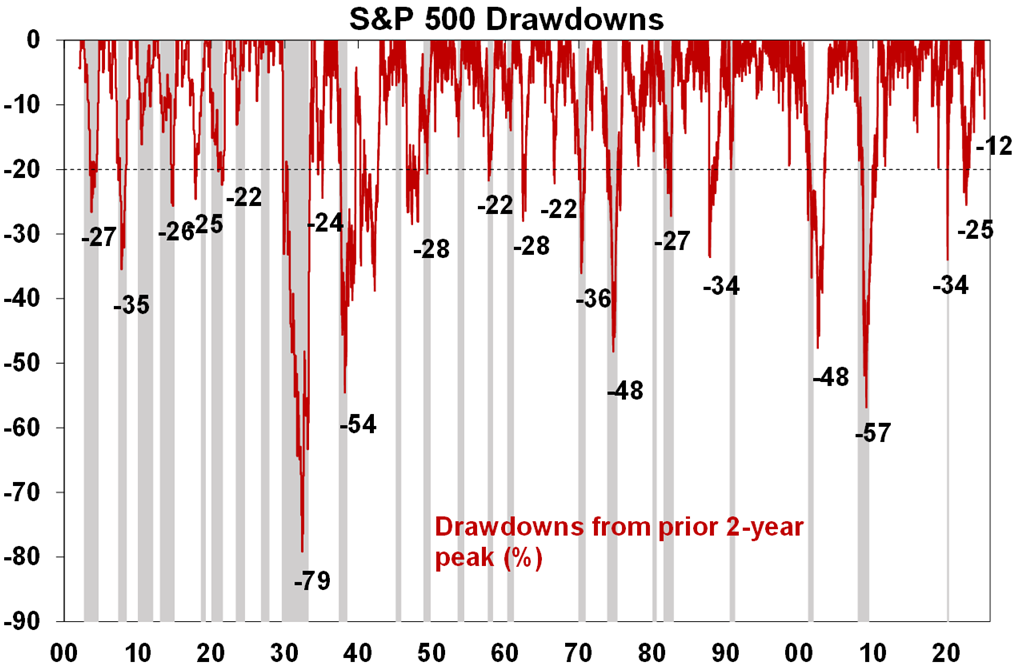

The Trump Dump – so far the fall in shares from their highs earlier this year – down 12% in the US, 11% globally and 10% in Australia – is a bit of a non-event in the context of past share market downturns (see the next chart which goes back to 1900), but its likely to have further to go as we start to see weaker economic and profit data flowing from Trump’s trade war.

Source: Bloomberg, AMP

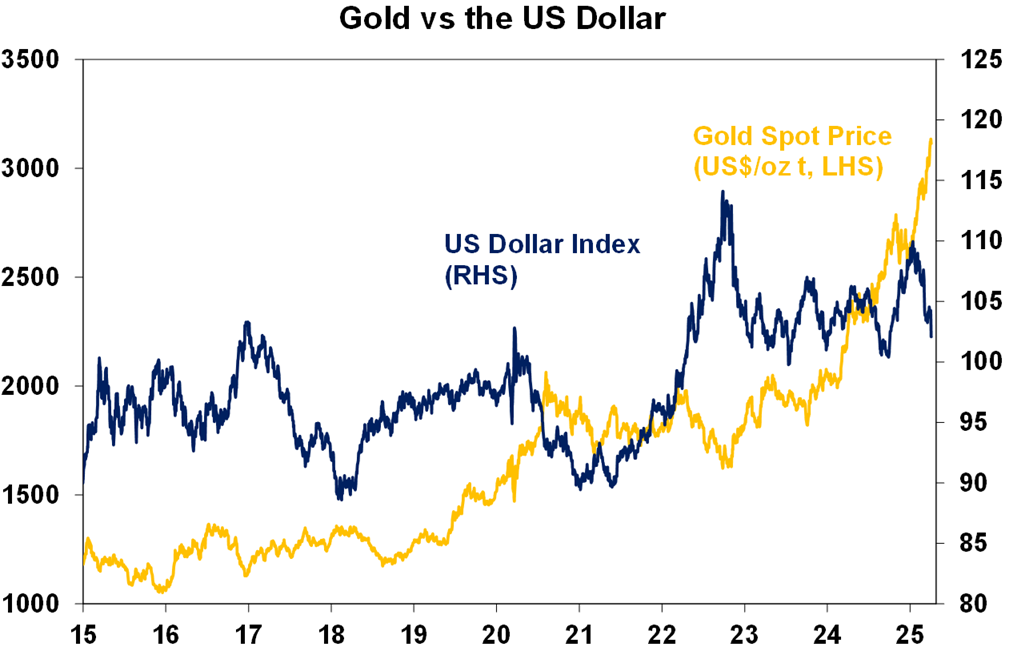

As can be seen in the next chart while gold is being true to its reputation as a safe haven, surging to new highs in the past week, the $US is not and appears to be under pressure from a combination of expectations that the tariffs pose a greater threat to US growth than non-US growth, possibly an emerging loss of faith in the US given Trump’s erratic policy making and investors re-weighting away from US assets in response. Put simply “US Exceptionalism” is being questioned. This in turn may accelerate de-dollarization and may add to pressure on non-US central banks, to cut their interest rates as their currencies are not falling and playing the shock absorber role that would normally be expected to flow from higher US tariffs. This includes the RBA given the $A which has actually risen over the last week, in contrast to its status as a “risk off currency”.

Source: Bloomberg, AMP

Trump’s 2nd April Liberation – or rather Retro – Day tariff hit was worse than expected. Every so often the US seems to hanker for a return to the 1950s. This happened in the 1970s with American Graffiti and Happy Days and so it is again! But its a lot more serious this time. The trouble is that the so called Golden Age of the US in the 1950s when everyone drove a Chevy or Cadi and played with hula hoops are long gone and return to that manufacturing nirvana is impossible: it will take years for companies to return production to the US; it will mean big price rises for Americans on imports or on higher cost domestically made products; most Americans don’t aspire to work in factories anyway; and even if manufacturing does return it will mainly be jobs for robots. Anyway, here are the key points:

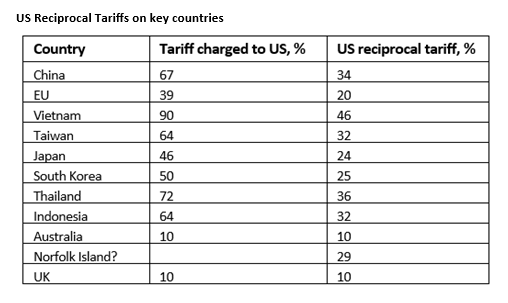

- Trump is putting a base 10% tariff on imports from all countries including those with which the US has a trade surplus like Australia, the UK and Brazil, but applying a higher “reciprocal tariff” to many countries that the US has a trade deficit with including China, Europe, Japan and South Korea.

- The reciprocal tariffs are supposed to compensate for the Trump Administration’s calculation of what barriers US exports to those countries face. See the second column in the next table. But it’s based on a whacky formula that compares the US trade deficit with a country with its exports to the US – the bigger the gap the higher the reciprocal tariff. Eg for the European Union it is the US’s $236bn trade deficit with EU divided by the EU’s $606bn in exports to the US which gives 39%…which is then halved because Trump is such a nice guy! This supposedly reflects tariff and non-tariff barriers but makes no allowance for the fact that even if a country has a trade balance in total it will have deficits with some countries and surpluses with others and the reality that the US spends more than it earns or produces as a nation which is the key driver of its chronic trade deficit. As such the reciprocal tariff formula and resultant tariffs are completely non-sensical.

- There are exemptions for: imports from Canada and Mexico which already face 25% tariffs, although the exemption for USMCA compliant goods remains; autos, steel and aluminium which already face a 25% tariff; and for sectors like pharmaceuticals and copper which will likely see their own tariffs. The de minimis exemption for low cost online imports from China was removed. Bad news for US Temu shoppers.

Source: US Government

- While the tariff on Chinese imports was set at 34%, it’s really 54% (or maybe 68%!) based on comments by Treasury Secretary Bessent that its on top of the 20% fentanyl tariff.

- Countries will find it hard to negotiate the reciprocal tariffs back down because the Administration has focussed on non-tariff barriers, like regulations and consumption taxes which many countries like Europe and Australia won’t change.

- While Trump has complained about our bio security laws restricting US beef exports to Australia and other things, even if we removed everything the US is complaining about we would still be subject to the 10% tariff as it is the new minimum. And why was Norfolk Island in there? It’s part of Australia and doesn’t even export to the US!

- Given the size of the US tariffs, retaliation is to be expected taking us further into a trade war.

- The tariffs are starting to look less about negotiation and more about raising tax revenue to pay for tax cuts and returning production back to the US. This is bad news for share markets and the latter two objectives are in conflict anyway because if all production is returned to the US tariff revenue will be zero.

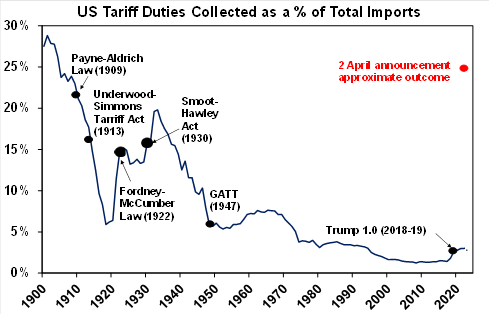

Overall, the tariffs are worse than expected. Our rough calculation is that the 2nd April announcement will take the US average tariff to above levels seen in the 1930s after the Smoot/Hawley tariffs.

Source: US ITC, AMP

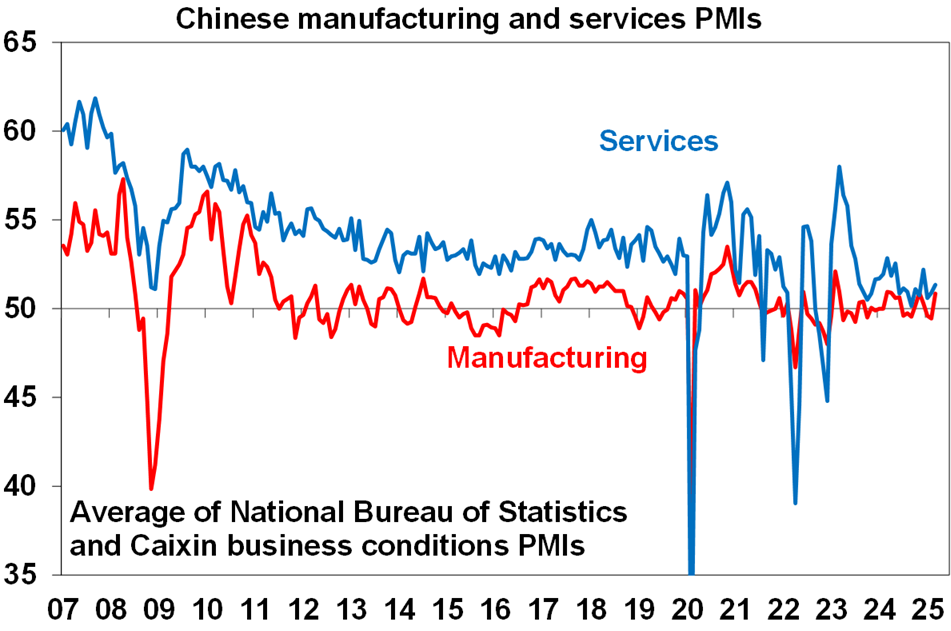

The risk of recession has gone up again. The good news is that we may be getting close to the top on US tariffs, which may help settle markets down. The bad news is that the US may still do more with sectoral tariffs, much depends on retaliation from other countries and how the US in turn responds to a trade war and the risk to the global growth outlook has increased substantially so weaker economic data and profits lie ahead. The risk of a US recession was already rising with US households having run down their pandemic savings buffers and thanks to a further blow from the latest tariffs – which amount to a roughly $US600bn or 2% of GDP tax hike which is the biggest tax hike since 1968 – to confidence and supply chain disruptions is probably now around 45%. A rough estimate is that the hit to US growth will be at least 1%, with a similar amount added to US inflation. Global growth could be pushed towards 2% (from 3% currently) depending on how significant retaliation is and how countries like China respond with policy stimulus. For the China the 54% tariff rate could knock 2 percentage points off its growth – fiscal stimulus could probably offset half of this but it still risks seeing growth slowing to 4% from around 5% last year.

For Australia, the 10% US tariff on our exports is bad news for the industries affected and there is likely more to come for pharmaceuticals (worth $2bn a year). However, only 5% of Australian exports go to the US worth about 0.9% of GDP and much of this will still continue albeit they are now more expensive in the US. So, all up the direct hit to GDP growth is probably around 0.1-0.2%. However, the bigger threat comes from the hit to global growth from Trump’s trade war, particularly in China and Asia, which will likely result in less demand for our exports posing a threat to the expected pick up in Australian economic growth. If we avoid retaliatory tariffs on US imports (as appears likely) and the $A remains stable, Trump’s tariffs are more likely to hinder growth than boost inflation, supporting further RBA rate cuts.

Given the even bigger threat to global growth flowing from Trump’s latest round of tariffs it looks like share markets will have a further leg down. Our assessment remains that global and Australian shares will have a 15% plus correction measured from this year’s high. A 10% fall in US shares was not enough to put pressure on Trump but a 15% plus fall likely will at some point resulting in some moderation in the tariffs and refocus on the market positive aspects of his agenda, like tax cuts and de-regulation. In this regard the pressures on Trump are growing with collapsing consumer and business confidence, four Republican Senators voting with Democrats to reject the tariffs on Canada, Europe moving to purchase its own rather than US weapons in rearming, Elon Musk looking like he is on the way out and Congress now having the revenue from the tariffs to move faster on its tax cuts. And eventually the Fed will likely respond with rate cuts, although this may be delayed given US tariffs will also add to US inflation. Lower share prices & a US pivot away from tariffs to more positive supply side policies will eventually create buying opportunities for investors, but there may be a way to go yet.

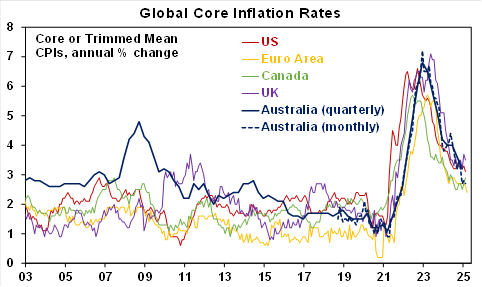

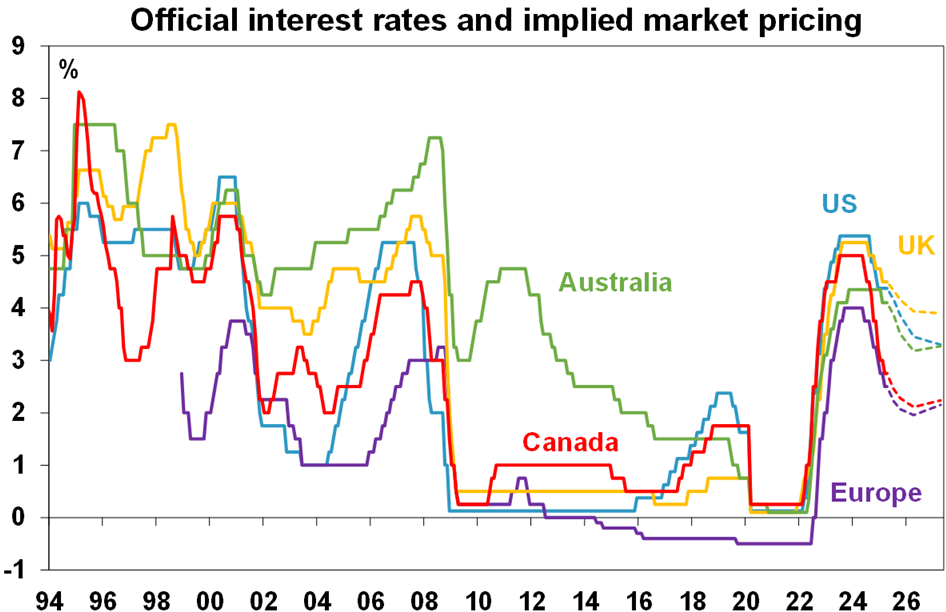

Some good news? Inflation and interest rates (and most economic data) are now taking a back seat to the noise around US tariffs, but there is plenty of scope (unlike going into the pandemic) for central banks to cut rates to support growth in the face of the tariff hit. On this front in the last week Eurozone inflation for March fell to 2.2%yoy with core inflation dropping to 2.4%yoy and another ECB rate cut is looking certain in April.

Source: Bloomberg, AMP

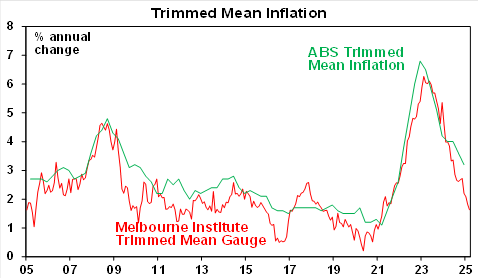

In Australia, the RBA left rates on hold at 4.1% and remains cautious, but it was a bit more dovish than back in February. In particular, RBA Governor Bullock did not push back as much against market expectations for further easing as was the case in February. Our assessment is that the 20 May meeting is “live” for another cut with the key being the March quarter CPI due 30 April, Trump’s escalating tariffs and the RBA’s revised forecasts. With trimmed mean inflation likely to come in below RBA forecasts, the US trade war escalating and the RBA likely to revise down its underlying inflation forecasts we expect another 0.25% rate cut in May. We were already expecting another cut in August and then February taking the cash rate to 3.6%, but there is now a good chance we will see another one or two cuts on top of this as a result of the threat to growth posed by Trump’s tariffs. The money market now sees four more RBA cuts this year. More rate cuts than otherwise might be the silver lining in the Trump cloud for Australians with a mortgage.

Source: Bloomberg, AMP

The Australian election campaign is now well underway with minority government the most likely. The cost of living remains the big issue, but with the major parties so far offering mostly band aid solutions rather than fundamental long-term measures to boost productivity, although the Coalition looks to be slightly ahead given its focus on smaller government and less regulation. Two party preferred polling is running around 50/50 with the most likely outcome remaining that the Coalition won’t win enough seats to govern even with cross benchers and Labor will lose its majority and have to rely on cross benchers to form government which if the Greens are required could make it harder to get reforms done and push the government in a less business friendly direction which could worsen productivity.

Major global economic events and implications

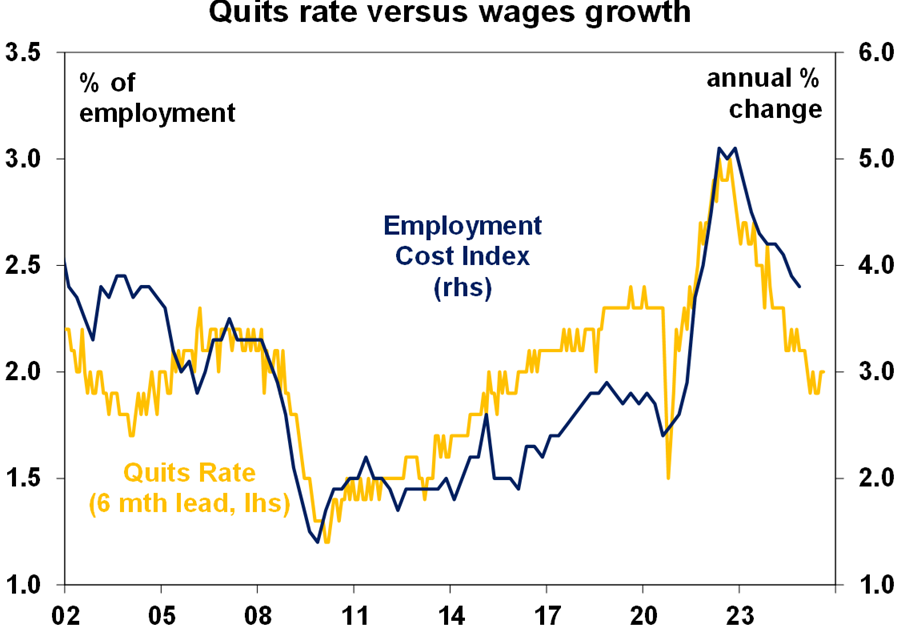

US economic data continues to highlight the negative impact of tariffs and public sector cutbacks. The manufacturing and services conditions ISM indexes fell in March with orders and employment down but prices continuing to rise for manufacturers with anecdotes continuing to cite tariffs. Job openings and quits for February fell with hiring remaining low and the quits rate pointing to a further slowing in wages growth. Separate data showed still low jobless claims but a 200% surge in layoffs on a year ago.

Source: Bloomberg, AMP

Japanese data was mostly good with unemployment down, industrial production and retail sales up and business conditions solid accord to the Tankan business survey.

Chinese business conditions PMIs edged up in March but remain relatively soft and in the same range of the last few years.

Source: Bloomberg, AMP

Australia economic events and implications

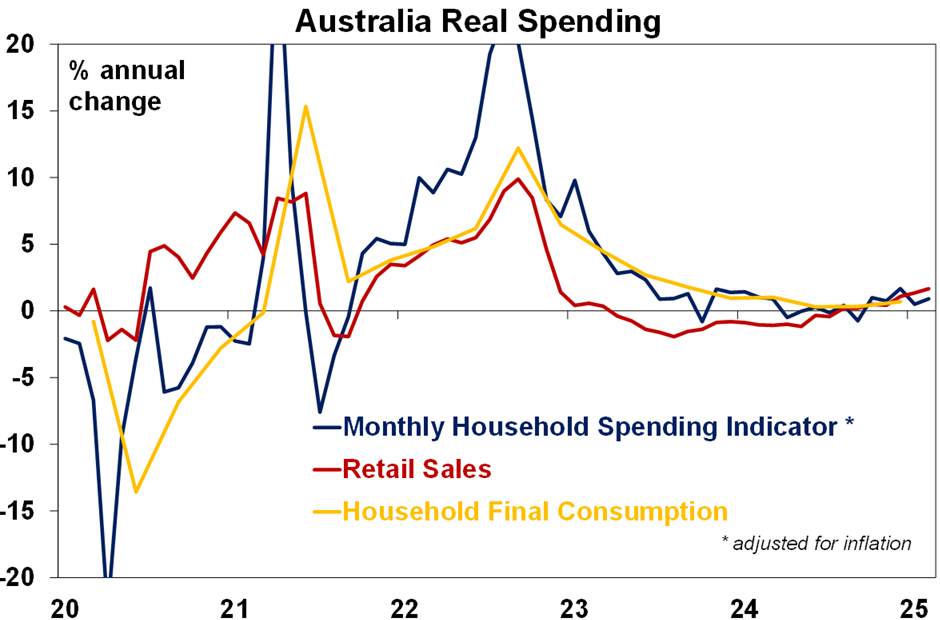

Australian economic data over the last week was consistent with a further modest pick up in economic growth. Retail sales and overall household spending rose 0.2% in February continuing a modest rising trend in real consumer spending suggesting consumers remain cautious but tax cuts and prospects for lower interest rates are helping.

Source: ABS, AMP

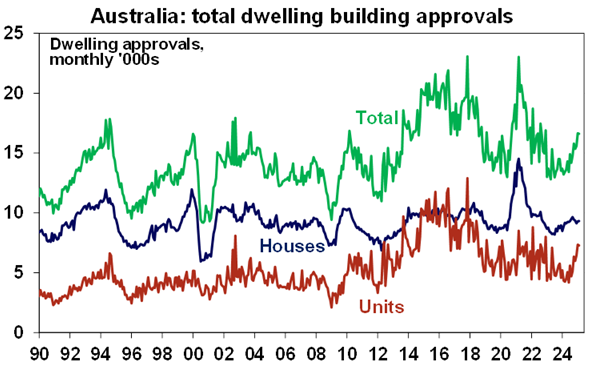

Building approvals fell 0.3% in February but this followed a 6.9% rise in January and the trend is clearly up. Approvals are now running around 195,000 a year which is roughly in line with underlying housing demand from population growth, albeit after two years of a big shortfall.

Source: ABS, AMP

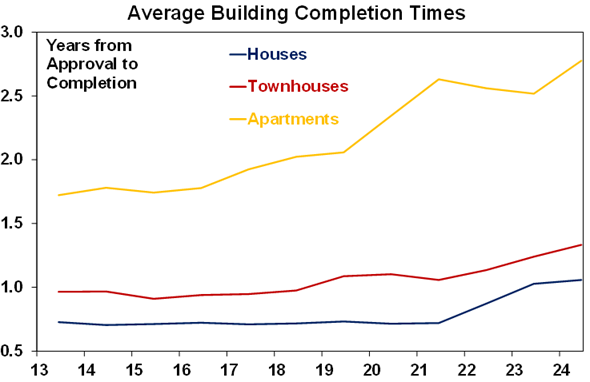

A concern is that its taking almost twice as long to complete a dwelling than was the case a decade ago, making it harder to get the accumulated housing shortfall (of at least 200,000 dwellings) down. Regulatory issues are impacting and need to be addressed.

Source: ABS, AMP

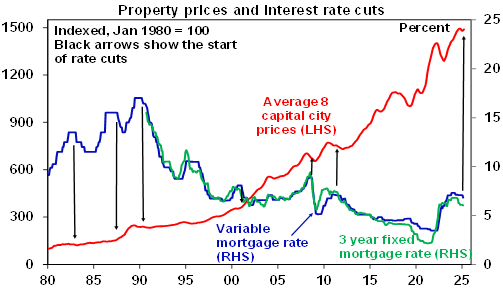

National average home prices continued their modest upswing in February, with further gains likely on the back of more rate cuts and the housing shortage but constrained by poor affordability.

Source: CoreLogic, AMP

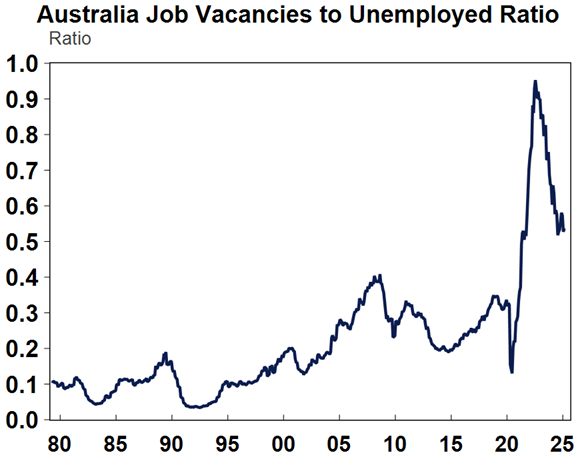

On the negative side, job vacancies fell in the March quarter. They remain high but still point to some labour market cooling.

Source: CoreLogic, AMP

Meanwhile, the Melbourne Institute’s trimmed mean Inflation Gauge slowed to just 1.6%yoy in February, suggesting a continuation of the downtrend in the ABS’s trimmed mean.

Source: CoreLogic, AMP

What to watch over the next week?

In the US, apart from the ongoing tariff noise its back to focussing on inflation on the data front. March CPI inflation (Thursday) is expected to drop to 2.6%yoy from 2.8% with core inflation also dropping to 3%yoy from 3.1%. Unfortunately, the latter is due to base effects with monthly core inflation expected to rise 0.3%mom up from 0.2% in February. Producer price inflation data will be released Friday and small business optimism data is released Tuesday.

In China, CPI inflation for March (Thursday) is expected to bounce back to a still weak 0.2%yoy after a distortion due to the early timing to the Lunar New Year holiday pushed it down to -0.7%yoy in February. Producer price deflation is likely to remain though at around -2%yoy.

In Australia, consumer confidence for April is likely to pull back a bit from the gain seen in March and NAB business survey conditions and confidence are likely to remain around average levels (with both due Tuesday).

Outlook for investment markets

After the double digit returns of 2023 and 2024, global and Australian shares are expected to see far more constrained returns this year. Stretched valuations, the now high risk of a US recession, Trump’s trade war and ongoing geopolitical issues – including a high probability that the US will launch strikes against Iran’s nuclear capability if diplomacy doesn’t work – will likely make for a volatile ride with a 15% plus correction highly likely. But central banks, including the RBA, still cutting rates and Trump’s tax and deregulation policies ultimately supporting US shares, should still mean okay investment returns through the year as a whole. But its likely to be a rough ride.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest given poor affordability. We see home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside in response to Trump’s tariff hit to growth.

Ends