The 2025-26 Budget – pretty uninspiring, with deficits for years

26/03/2025 07:48:52

Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP, discusses the budget.

- Many measures were pre-announced, but key new measures include tax cuts from 2026-27 & more cost of living support.

- While the revenue windfall is expected to continue, its mostly being spent on new measures resulting a return to deficit of $27.6bn this financial year and $42.1bn next year.

- The Budget continues to lock in structurally higher spending and budget deficits for the medium term.

- The ongoing high level of public spending risks higher than otherwise underlying inflation and weaker productivity.

- Overall, it’s a pretty uninspiring Budget.

Introduction

Key budget measures

- $17.1bn in tax cuts over the next four years, cutting the 16% tax rate to 14% – but they’ll buy less than “a sandwich & milkshake” amounting to $5.15/week from July next year and $10.3/week from July 2027.

- $7.9bn on Medicare to boost bulk billing, $1.8bn for public hospitals, $644m for new urgent care clinics & $793m for women’s health.

- More money for infrastructure including $7.2bn for the Bruce Highway, along with various other road and rail projects.

- More cost of living relief including extending electricity rebates for another six months at $150 per household and small business (costing $1.8bn) and $689bn to lower PBS drug prices from $31.6 to $25.

- $800m to raise the income and price caps for the Help to Buy shared equity scheme (although it remains capped at 40,000 places over four years) and $54m for pre-fabricated and modular homes.

- $1.2bn extra for disaster relieve and rebuilding after Cyclone Alfred.

- Another freeze to deeming rates & a two-year freeze to beer indexation.

- Subsidies to help industries affected by Trump’s tariffs, support for the Whyalla steel works and $20m for a “Buy Australian” campaign.

- Spending of $1.5bn over 5 years in “decisions made but not yet announced” allowing for more election promises.\

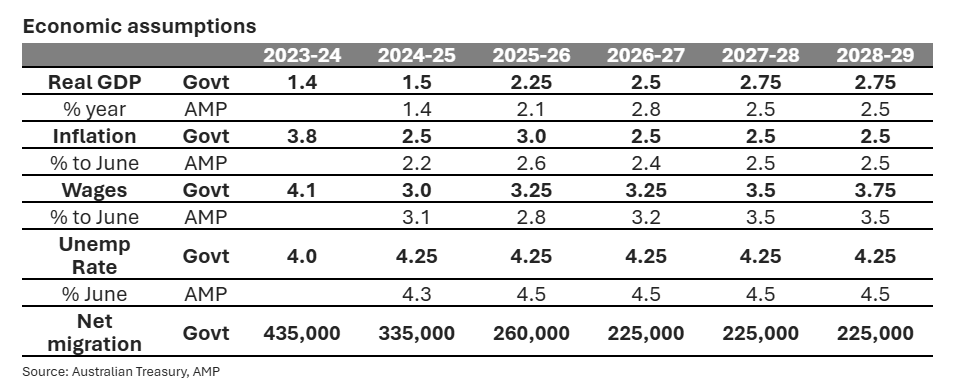

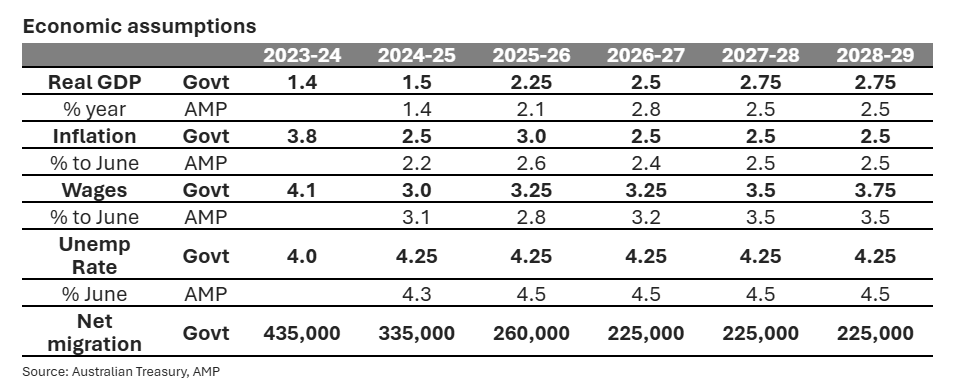

Economic assumptions

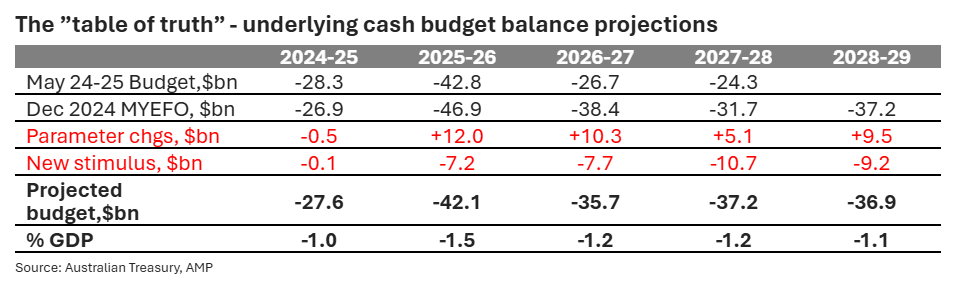

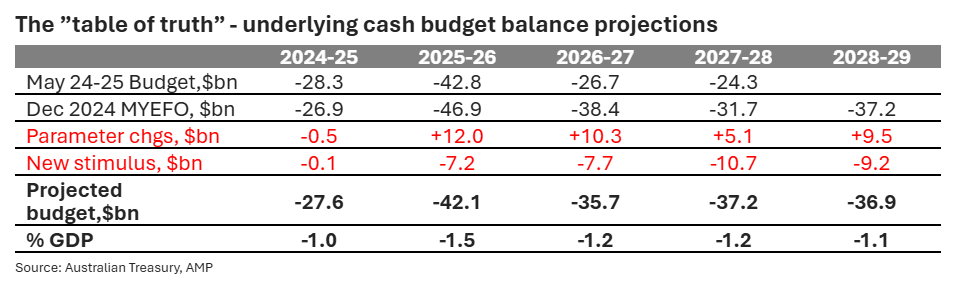

Back to budget deficits

After two surpluses we are now back into deficits for the next decade.

After two surpluses we are now back into deficits for the next decade.

Winners and losers

Losers include: tax evaders, scammers & consultants with more measures to curtail them.

Assessment

However, the Budget has several significant weaknesses in relation to:

- Inflation and the RBA. The cost-of-living measures will help lower measured inflation. But the new stimulus, the shift from surplus to deficit and average 5.5%yoy projected growth in Federal spending to 2028-29 will boost demand in the economy. All of which makes the RBA’s job harder. We don’t think it precludes more rate cuts, but it means rates will be higher than would otherwise have been the case.

- Structural deficits. The Budget continues to lock in structural budget deficits. This sees no money put aside for a rainy day over the forecast period. The ratcheting up of spending on temporary revenue windfalls (amounting to over $300bn for the current Government) leaves the budget vulnerable to a reversal of the windfalls.

- Reliance on bracket creep to boost revenue beyond 2028-29 and return to surplus. The rising burden on Millennials & Gen Z is unfair and unrealistic. Politicians will eventually want to give some back as “tax cuts”. So how will we get back to surplus then?

- Off budget spending. This is becoming a big issue as governments have been allocating increasing spending as “off-Budget” on the grounds that it’s an “investment”. This is resulting in a widening gap between the underlying cash balance (referred to above) and the headline balance (which includes “investments”). However, much of the spending are not wise investments but they add to public debt.

- Bigger government. Spending as a share of GDP is settling well above that seen pre pandemic, locking in big government which risks slowing productivity growth. And the problem will escalate if Australia is forced to rapidly push defence spending up to 3% of GDP costing $30bn pa.

- More protectionism. While “made in Australia” is popular, its reliance on protectionism and government picking winners has been tried and failed in the past with a long-term cost to productivity & living standards. We have no advantage in batteries & solar panels.

- Productivity. Despite the rhetoric there is not really much to improve Australia’s poor productivity performance. This needs urgent reform in terms of tax, competition, the non-market services sector, industrial relations and energy generation. This is where the focus needs to be if we want to strengthen the economy ahead of Trump’s disruption not on “made in Australia” subsidies and “Buy Australian” campaigns.

- Housing. The measures to boost pre-fabricated housing are good, but unlikely to be enough to hit the 1.2 million new homes over 5 years target. Help to Buy will only help the lucky few who get in early.

Implications for the RBA

Implications for Australian assets

– cash and deposit returns have likely peaked with RBA cutting rates – the Budget may keep them higher than otherwise.

Bonds – medium term deficits put pressure on bond yields, but they are roughly as expected so there is not much in it.

Shares – the Budget is positive for spending and hence retail shares, but this may be offset by higher than otherwise rates. Some manufacturers may benefit from subsidies. Overall, it looks neutral for shares.

Property – the housing measures are unlikely to alter the home price outlook. We see modest home price growth this year.

The $A – the Budget is unlikely to change the direction for the $A.

Ends