Dr Shane Oliver, Chief Economist & Head of Investment Strategy at AMP, provides his weekly market update.

Investment markets and key developments

Global share markets mostly rebounded over the last week from oversold conditions helped by an absence of new tariff comments from Trump and as the Fed helped calm recession and inflation fears. While US, European and Japanese shares rose Chinese shares fell though partly due to disappointing stimulus announcements. The absence of new tariff announcements saw the Australian share market bounce around 2% over the last week from oversold conditions with gains led by supermarkets – after the ACCC found no clear evidence of price gouging, energy, financial and utility shares. Bond yields mostly fell slightly over the last week suggestive of growth worries but oil and metal prices rose suggestive of little concern about growth, although copper and gold (which reached a new record high) are still being boosted by US demand ahead of feared tariffs. Safe haven demand and central bank buying are also boosted the gold price. The $US rose slightly & the $A fell slightly, and Bitcoin was little changed.

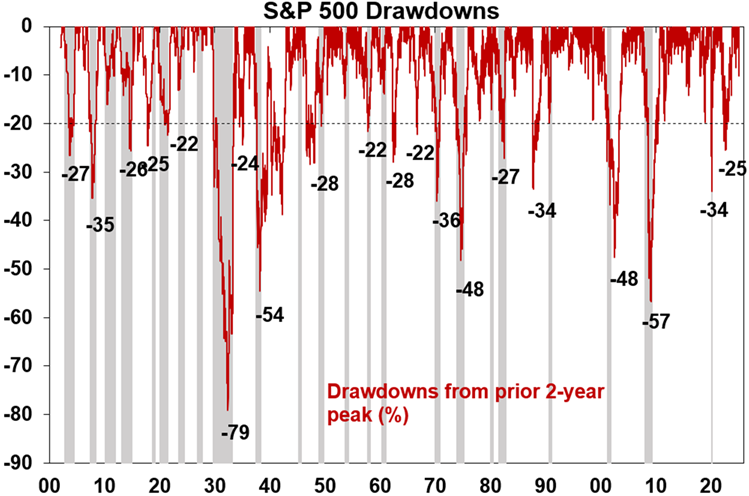

While the volatility in shares over the last few weeks has caused much excitement so far it’s a bit of a non-event in an historical context. For example US shares had a 10% top to bottom fall but as can be seen in the next chart its hardly unusual.

Source: Bloomberg, AMP

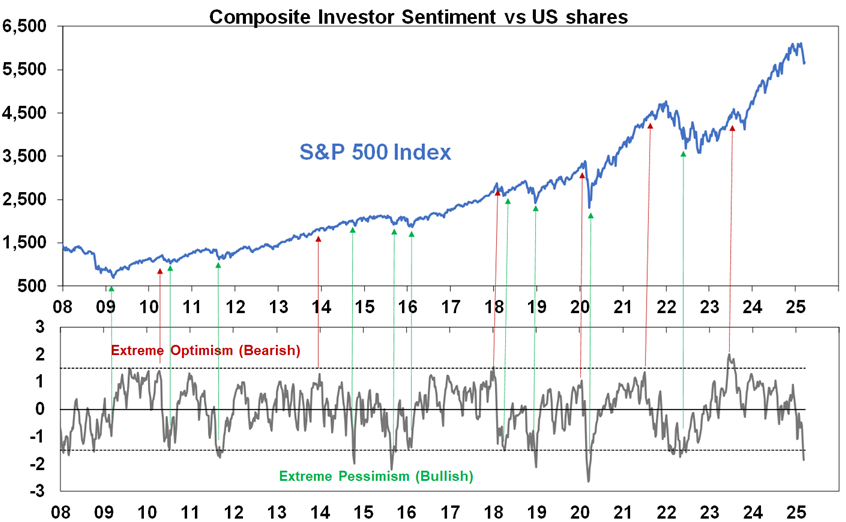

A quieter week on the tariff front – is the worst over or is it just the calm before the storm? The good news is that past week has seen: less manic tariff noise from Trump amidst reports that US Trade Representative Jamieson Greer is trying to inject some order into the process; some analysts and commentary suggesting that “reciprocal tariffs” will be less threatening as they could be negotiated away by other countries removing whatever is upsetting Trump; the Fed injecting some calm into the situation by saying growth is still solid and that while inflation looks like being a bit higher than expected this year (mostly due to the tariffs) it should be “transitory” (what – not that word again!); and shares being able to rally from an oversold position with negative sentiment is a good sign. In fact, investor sentiment reached levels often associated with major share market bottoms. See the next chart.

Sentiment based on surveys of investors, VIX & put/call ratio. Source: Bloomberg, AMP

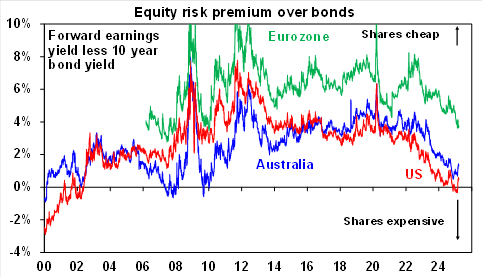

However, it’s too early to call the all clear as: there is much more to go on tariffs with 2nd April being the big day and in particular China and Europe look like being big targets; reciprocal tariffs risk being very complex, arbitrary and irrational (eg if applied in relation to non-protectionist measures like value added taxes) and likely to lead to retaliation; US Commerce Secretary Lutnick and Treasury Secretary Bessent are not appearing to be the stabilising force/adults in the room that many had hoped for and on some occasions add to the instability; despite the correction shares are still not cheap still offering very little risk premium over bonds; while investor sentiment has become so negative that its positive, historically shares have sometimes still fallen further before bottoming; indications suggest the Trump administration wants to get back to where the global trading system was before China entered the WTO in 2001 but this will involve a huge adjustment; and the supply chain disruption and impact on confidence threatens to significantly weaken global growth and boost inflation in the US and countries that retaliate.

Source: Bloomberg, AMP

For Australia, while we are not the main focus of Trump’s ire the risk remains high of more tariffs on our exports to the US – notably pharmaceuticals (worth $2.1bn last year) and meat ($6.1bn) and all our exports generally (totalling $23.8bn) as part of Trump’s “reciprocal tariffs” given US gripes with our bio security laws, GST, pharmaceutical benefits scheme (which favours generic drugs), our social media laws and our lower level of defence spending. The overall macro impact of this on Australia would likely be minor though as our total exports to the US are less than 1% of our economy and are of a similar value to those exports that were blocked from China in 2020. But the real risk for Australia remains the impact of a global trade war resulting in weaker global growth and hence less demand for our exports.

So given the ongoing and still escalating tariff disruption and its flow on to US, global and Australian economic activity we continue to see a high likelihood of a 15% plus correction in global and Australian shares before the tariff war settles down and more positive forces around Trump’s tax cuts and deregulation and hopefully more rate cuts get the upper hand.

Meanwhile, the news from central banks was mixed over the last week:

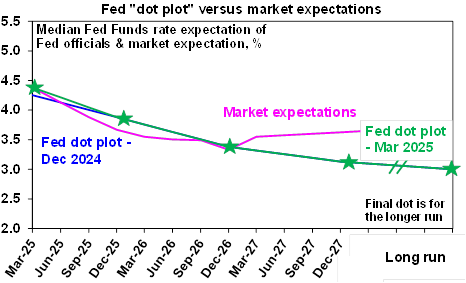

- The Fed left rates on hold and remains in no hurry to ease. Its now less upbeat on the outlook (seeing slower growth and higher inflation this year) and Fed officials are less positive on rate cuts. However, it sees the boost to inflation from the tariffs as “transitory” (not a good word to use given 2022!), still retains an easing bias and its dot plot of Fed officials rate forecasts still sees two rate cuts this year and

Source: Bloomberg, AMP

- The Bank of England left its key rate on hold at 4.5% but while it noted increased uncertainties flowing from the tariffs it leaned a bit hawkish on inflation signalling a slower pace of rate cuts.

- By contrast the Swedish central bank which left rates on hold at 2.25%, leaned dovish.

- The Swiss Central bank cut rates again to just 0.25% citing a more uncertain economic outlook.

- The Bank of Japan left its key rate at 0.5%, but while its monitoring Trump’s tariffs it appears biased towards further gradual hikes, but the next hike likely won’t occur till mid-year.

- In Australia, while the RBA remains less optimistic than money market pricing for rate cuts, we continue to see the US tariffs as adding to the case for further RBA rate cuts and our view remains for the next cut in May.

The Federal Budget on 25 March is likely to highlight a spendathon ahead of the election (mostly matched by the Coalition) and confirm a likely return to budget deficits. Much of the new spending has already been announced so there will likely be few surprises, but the Government will likely use the Budget as an opportunity to package up its already announced election policies with some new one’s ahead of the formal election campaign. The good news is that the revenue windfall from stronger than expected employment and commodity prices along with bracket creep will mean the starting point for the budget will be $10-15bn better this financial year and next. But the Government has already racked up an extra $37bn since January in new spending measures over the next four years as part of its election campaign – on Medicare, roads, the NBN, school funding, cheaper drugs, another freeze to deeming rates, subsidies to help metal producers, etc. And the Treasurer has indicated that another $1.2bn will be included for disaster recovery following Cyclone Alfred. However, there will still be some new measures in the Budget including:

- another round of $300 per household electricity rebates or something similar costing $3.5bn in the next financial year (otherwise average electricity bills could rise 30% or so reflecting another rise in underlying electricity prices on 1 July and the current gap between underlying and subsidized prices);

- more subsidies to support Australian industries affected by Trump’s tariffs and maybe more spending on Future Made in Australia subsidies (all of which is economically dubious and just another form of protectionism);

- more funding for a buy Australian campaign; and

- more defence spending to partly address Trump’s gripes that we only spend 2% of GDP on defence, but the problem is that getting defence up to 3% will add around $28bn to the deficit.

Netting this out will likely see this financial year’s budget deficit forecast revised down to around $17bn (from $26.9bn in MYEFO) and next year’s to $42bn (from $46.9bn) with deficits still projected out to mid next decade. The Government’s growth forecasts are likely to be revised down slightly for this year and next to 1.5% and 2.25%, with unemployment being revised down to around 4.2% and inflation forecast to remain around 2.5% helped by another round of electricity rebates. Net migration is likely to be revised down to around 300,000 from 340,000 for this financial year. We don’t expect the Budget to alter the outlook for interest rates but were it not for all the extra public spending RBA rates would be lower.

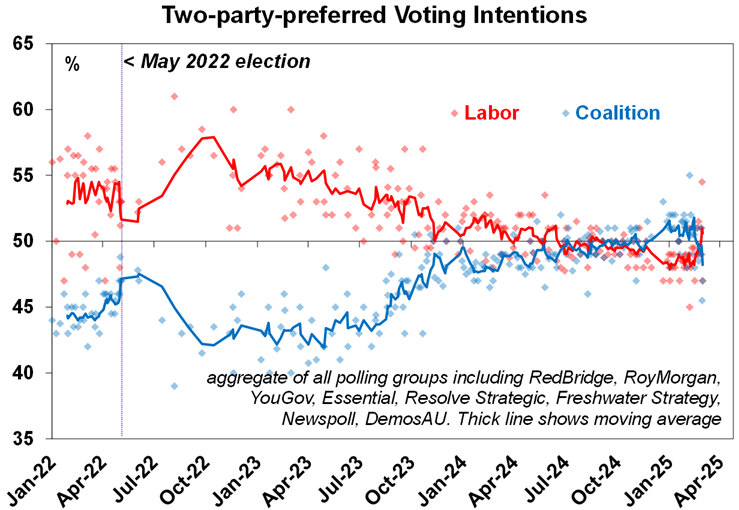

Soon after the Budget – possibly next Sunday – the Government will call the election (which is due by 17 May). Interestingly, two party preferred polling has shown some swing back to Labor in the last two weeks. There is a way to go though and the most likely scenario is that the Coalition won’t win enough seats to govern even with cross benchers and Labor will lose its majority and have to rely on cross benchers to form government which if the Greens are required could make it harder to get reforms done and push the government in a less business friendly direction which could worsen Australia’s productivity performance. If Government is formed with the teals it could lead to a more reform-oriented approach, but that is highly uncertain.

Source: Various polls as indicated, AMP

Major global economic events and implications

The OECD revised down its global growth forecasts for this year and next citing the disruption posed by Trump’s tariffs. That said the downwards revision was modest – to 3.1% for this year from 3.3% and growth around 3% is in the same range its been in for the last decade, abstracting from the pandemic. Of course, its early days with the tariffs at present.

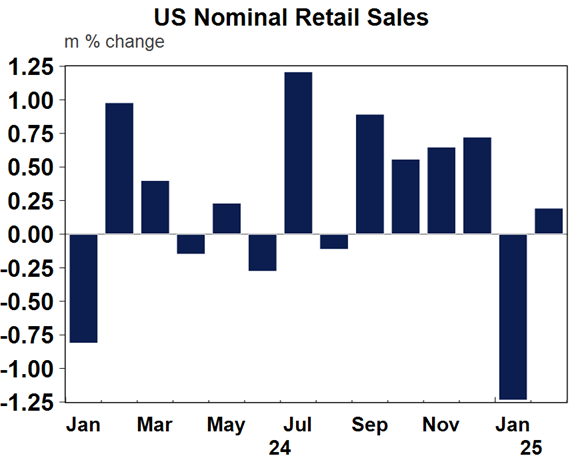

US economic data continues to highlight the negative impact of tariffs and public sector cutbacks. Housing starts and existing home sales rebounded in February after being depressed by poor weather in January, but both remain soft. Initial jobless claims also remain low. But retail sales were weaker than expected in February and point to soft growth in consumer spending this quarter, home builder conditions fell and manufacturing conditions in the New York and Philadelphia regions weakened. The regional manufacturing surveys also showed an increase in price pressures.

Source: Macrobond, AMP

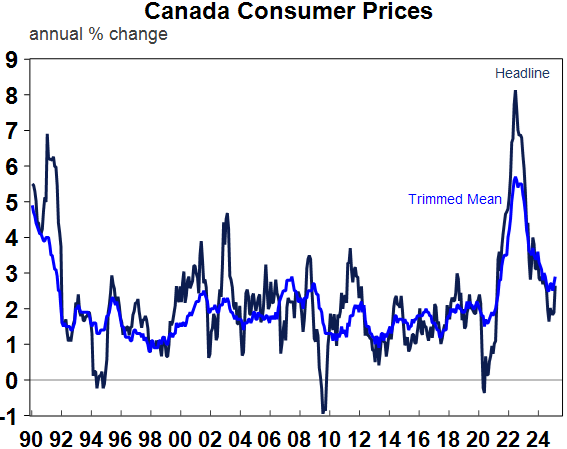

Canadian inflation was stronger than expected in February, boosted by the end of a sales tax break. This will constrain the Bank of Canada in the face of Trump’s trade war, although another two rate cuts to 2.25% are still likely this year.

Source: Macrobond, AMP

The German Bundestag passed the plan to ease the constraint on debt and boost infrastructure and defence spending. This along with wider EU stimulus should provide a roughly 1% of GDP fiscal stimulus over the year ahead. The extra stimulus will help provide an offset to the downside from Trump’s tariffs. But the conflicting forces will also complicate things for the ECB keeping it very data dependent from meeting to meeting but we still expect it to cut its deposit rate to 2% or just below this year (from 2.75%).

New Zealand’s December quarter GDP growth came in stronger than expected at 0.7%qoq, but this followed two quarters of contraction, GDP is still down 1.1%yoy and the composition was soft. NZ growth is probably now improving though allowing the RBNZ to slow its rate cuts although its still likely to cut to 3% (from 3.75%) this year.

Japanese inflation slowed to 3.7%yoy in February as food and energy inflation slowed, but core inflation was flat at 1.5%yoy.

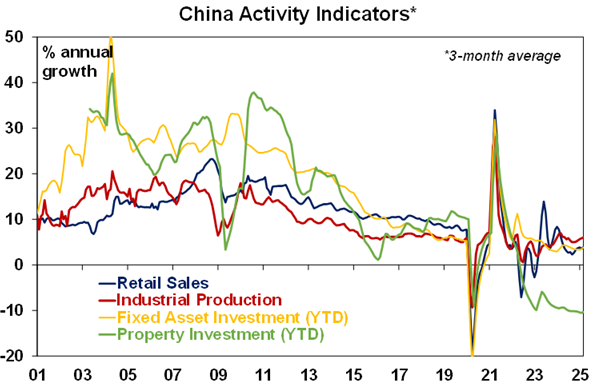

Chinese data for January and February showed a slight acceleration in the growth of retail sales, industrial production and investment with property sales and home price falls being less negative than a year ago. Unemployment rose though and this data was before the tariffs really started to impact. That said, China appears to be ramping up policy stimulus for consumers including measures to boost incomes and stabilise wealth, strengthen pensions and healthcare and look at a childcare subsidy. So far details are lacking though.

Source: Bloomberg, AMP

Australia economic events and implications

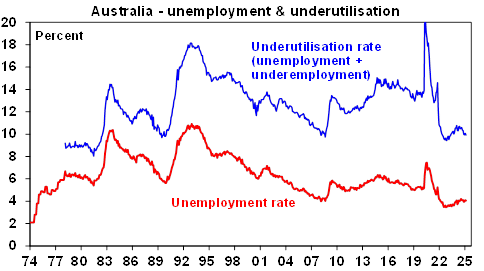

I’m outta here! Australian jobs data for February provided a confusing picture with employment down by 52,800, but participation also fell which saw the number of unemployed fall by 11,200 leaving unemployment flat at 4.1% as according to the ABS there were “fewer older workers returning to work in February”. It’s hard to believe that a whole bunch of boomers and Xers got to the end of January and suddenly decided to retire! So, the February jobs report looks more like noise than signal and is unlikely to change the RBA’s conclusion that the labour market is still tight.

Source: ABS, AMP

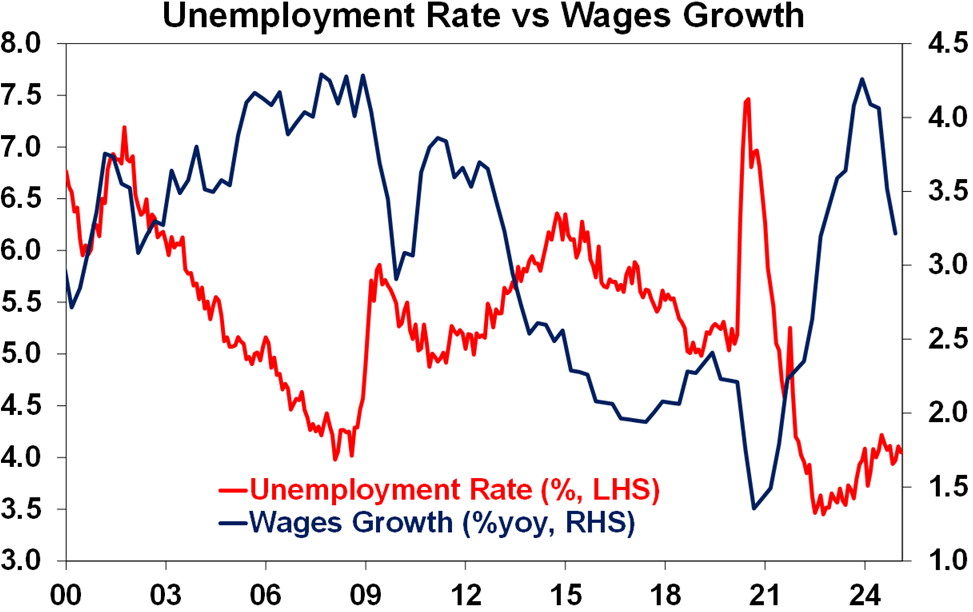

However, a combination of the surge in immigration and labour market participation in recent years which boosted labour supply; a surge in public sector related jobs in the care economy; labour hoarding; and the private sector facing tough economic conditions, likely means that the labour market is not as strong as it appears. In other words, the so-called Non-Accelerating Inflation Rate of Unemployment is not the 4.5% as estimated by the RBA but more likely around 4%. Which in turn is consistent with wages growth trending down despite unemployment remaining low. See the next chart. So, we remain of the view that the despite low unemployment compared to the experience of the last few decades, the RBA is likely to come to the view that this is not a threat to getting and keeping inflation down. So, we still expect the RBA to cut rates again in May and August.

Source: ABS, AMP

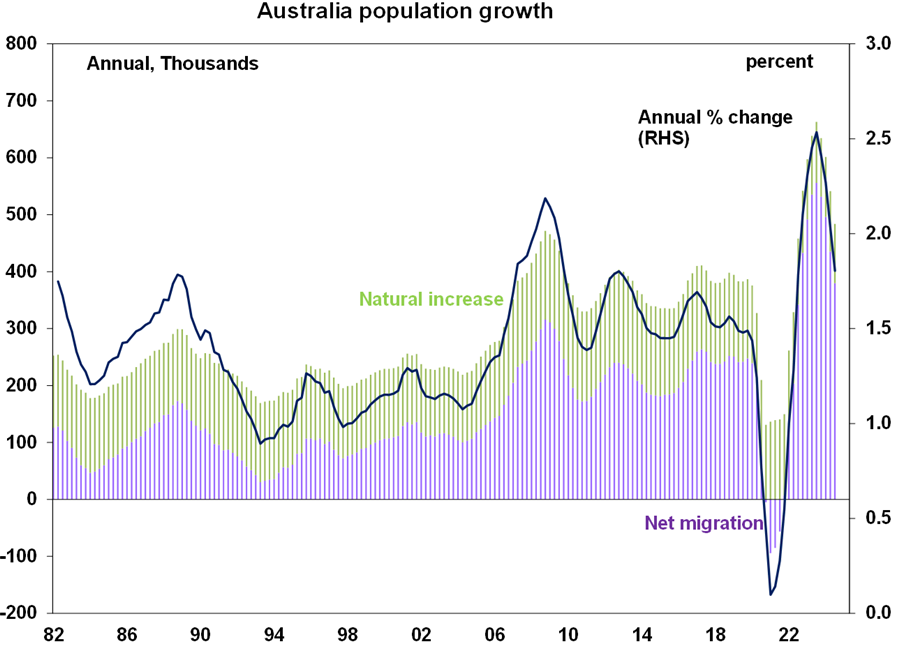

Australia’s population growth slowed to 1.8%yoy over the year to the September quarter last year, from a peak of 2.5%yoy a year earlier. This was due to a slowing in annual net migration to 380,000 from a record 560,000 a year earlier. But with the latest data showing population growth of 480,000, new housing supply running at around 175,000 dwellings a year is still below underlying demand of around 194,000 dwellings. At least the gap is narrowing.

Source: ABS, AMP

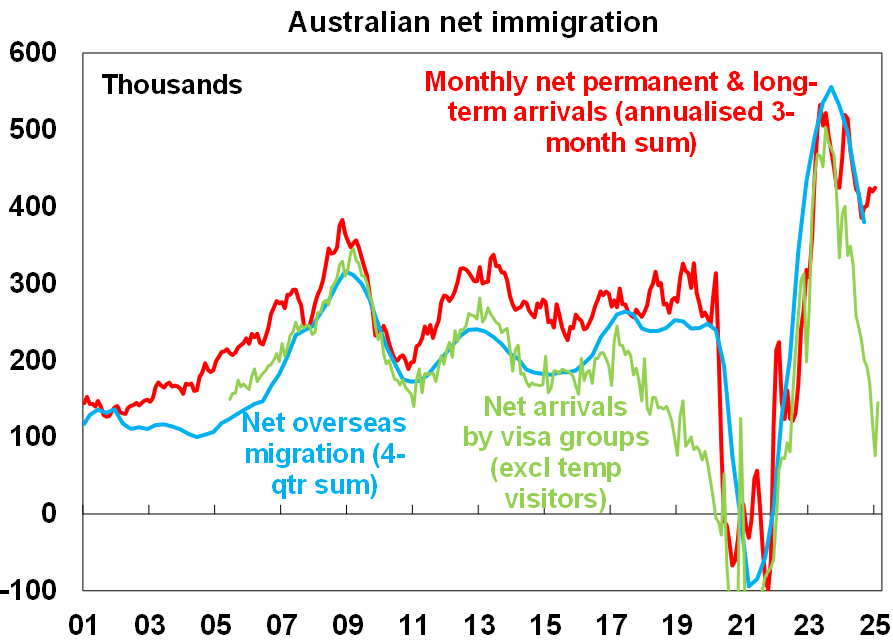

Monthly data provides a mixed picture as to how much further net migration has slowed with one approach based on visas pointing to a sharp fall but arrivals data suggesting immigration is stalling around current levels.

Source: ABS, AMP

What to watch over the next week?

The week ahead will see business conditions PMIs released for March (Monday) with the key focus likely to be on whether we see a continuation of the deterioration seen in the US (on the back of tariff worries) relative to Europe, Japan and Australia as we saw in February.

In the US, expect to see a further decline in consumer confidence and a slowing in home price growth (both Tuesday), underlying capital goods orders (Wednesday) to show modest growth, continuing modest growth in personal income and spending and a slight rise in core private final consumption inflation for February to 2.7%yoy from 2.6%yoy in January (all due Friday).

In Australia the Budget will be the key focus on Tuesday (see earlier for our preview) followed by Monthly CPI Inflation data for February on Wednesday. We expect inflation to fall to 2.4%yoy from 2.5%yoy with another sharp rise in electricity prices as more Queenslanders use up their $1000 electricity rebate and a seasonal rise in education costs more than offset by a fall in travel costs, slow dwelling price growth and a further slowing in services inflation. Business surveys continue to point to slowing selling price increases and trimmed mean inflation is likely to fall slightly to 2.7%yoy from 2.8%yoy. It’s doubtful that this will be enough to see the RBA ease again at its 1 April meeting preferring to wait and see the more reliable March quarter CPI data ahead of its May meeting where we do expect it to ease again.

Outlook for investment markets

After the double digit returns of 2023 and 2024, global and Australian shares are expected to see far more constrained returns this year. Stretched valuations, the increasing risk of a US recession, Trump’s trade war and ongoing geopolitical issues – including a high probability that the US will launch strikes against Iran’s nuclear capability if diplomacy doesn’t work – will likely make for a volatile ride with a 15% plus correction highly likely. But central banks, including the RBA, still cutting rates, prospects for stronger growth later in the year supporting profits, and Trump’s tax and deregulation policies ultimately supporting US shares, should still mean okay investment returns through the year as a whole.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest given poor affordability. We see home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside as Trump ramps up tariffs.

Ends